Geico Insurance review 2022

The Public authority Employees Insurance agency is a private American collision Insurance company with central command in Chevy Pursue, Maryland. It is the second-biggest auto safety net provider in the US, later State Homestead. GEICO is a Wholely possessed auxiliary of Berkshire Hathaway that gives inclusion to more than 24 million engine Cars claimed by more than 15 million arrangement holders starting in 2017. GEICO composes private traveler collision Insurance in every one of the 50 U.S. states and the Locale of Columbia. The Insurance company sells strategies through neighborhood specialists, called GEICO Field Delegates, via telephone straightforwardly to the purchaser using authorized Insurance specialists, and through their site. Its mascot is a gold residue day gecko with a Cockney pronunciation, voiced by English entertainer Jake Wood. GEICO is notable in mainstream society for its promotion, having made various advertisements expected to engage watchers.

Is Geico Car Insurance Good?

Indeed, Geico is a decent Car insurance agency for most drivers. Our yearly investigation of Car Insurance rates observed Geico is one of the least expensive Car guarantors in the country, coming in second in our positioning of the Least expensive Car Insurance agencies, and it figures out how to keep charges low while as yet offering great Customer assistance. Moreover, our consumer loyalty overview observed that Geico’s clients are probably going to prescribe the organization’s collision Insurance to loved ones. Geico took the third spot in our Best Car Insurance Companies Positioning.

Since Geico’s rates are extremely serious, accessible information uncovers that most drivers can probably set aside cash with Geico assuming they don’t fit the bill for USAA Insurance, which confines its enrollment to the military workforce and their families. More youthful drivers and people with inconsistent records are particularly great contenders for setting aside cash with Geico, however, we tracked down high rates for individuals with infractions on their driving record

Geico positions are third in our rundown of the best accident coverage organizations. Numerous respondents refer to “strong assistance and inclusion [options]” as purposes behind granting high scores, and the “simplicity of online approach organization” and other simple to-utilize highlights are among the champion credits of Geico’s collision Insurance arrangements.

Geico Customer Service

In our Best Safety net provider for Customer assistance sub ranking, Geico attaches with Ranchers for the fourth spot. USAA stands out among accident coverage organizations around here, and State Homestead and Cross country hold a slight edge over Geico in consumer loyalty. The midpack positioning doesn’t recount the whole story, in any case, as overview respondents were generally speaking content with their encounters. Of review respondents who didn’t record a Car Insurance guarantee with Geico, 53% demonstrated total fulfillment effortlessly of reaching Geico’s Customer care. Among respondents who documented a case, that number rose to 70%.

Geico Claims Handling

However respondents to our overview report solid consumer loyalty with Geico accident coverage generally, there are some flimsy points. With regards to claims Handling, Geico loses some ground to scratch contenders with center-of-the-pack execution. Of overview respondents who recorded a case, 74% report total fulfillment without breaking a sweat of documenting, 66% report total fulfillment with notices during the Claims interaction, and 70% report total fulfillment with the goal of the case. However these scores sound great, they’re beaten by contenders like USAA and Across the country. One study respondent said, “Outside of the case cycle, indeed, Geico has great Customer Service. During the case interaction, no. Geico has horrifying Customer care.”

Geico Customer Loyalty

With a general third-place positioning in our consumer loyalty review, it should not shock anyone that Geico appreciates solid unwaveringness from its Car Insurance policyholders. Geico procures the silver decoration in our Probably going to be Suggested sub ranking, and a fourth-place spot in our Best Safety net provider for Customer Dedication sub ranking. Geico’s Customer’s first way to deal with administration came about in 41% of respondents who had not documented a case saying they would probably suggest Geico. Among the people who had documented a case, that number increased by 49%.

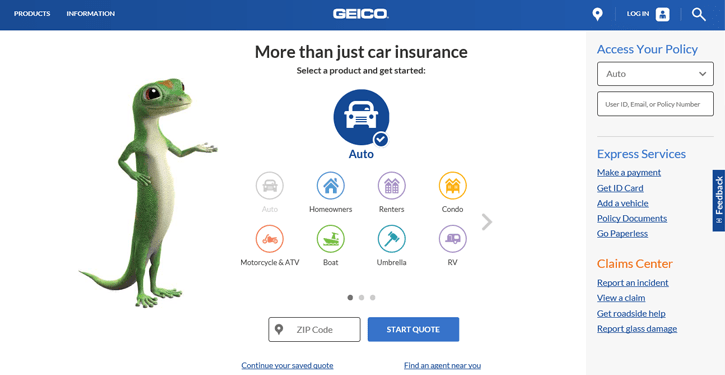

Geico Car Insurance

Geico Car Insurance offers inclusion for something other than Cars. Regardless of whether you have a car, truck, collectible Car, or an ATV, Geico has an approach to safeguard it.

Types of coverage

- Private passenger auto insurance

- Motorcycle insurance

- ATV insurance

- RV insurance

- Rideshare and on-demand delivery drivers insurance

- Collector auto insurance

- Car insurance for driving in Mexico

- Commercial vehicle insurance

Geico’s wide scope of accident coverage item types may make it simple for you to protect every one of your Cars in a single spot, which could make dealing with your Insurance a lot simpler.

How Much Is Geico Car Insurance?

Our yearly investigation of the Least expensive Car Insurance Companies observed that the vast majority can set aside cash with a Geico accident Insurance strategy, in any event, considering factors, for example, driving record and postal division.

As indicated by our information, Geico’s normal accident Insurance rate is $1,100, making it the second-least expensive Car backup plan in our review. The main less expensive significant company for accident Insurance is USAA, which has a normal pace of $875, which is a decline of around 20% contrasted with Geico’s rate. The public normal in our review is $1,321, which is a 20% expansion contrasted with Geico’s normal rates.

Geico life Insurance

Geico isn’t the most notable for its life Insurance arrangements, yet it gives three kinds of extra security inclusion.

Term life

Term life Insurance is one of the most widely recognized sorts of life coverage and is known for being more reasonable than long-lasting arrangements. Term strategies give inclusion to a particular measure of time, ordinarily somewhere in the range of 10 and 30 years. Term strategies can be a decent choice on the off chance that you want inclusion on a careful spending plan or the other hand assuming you just need inclusion for a specific measure of time, for example, while you take care of a home loan. Geico offers a No-Prescription Test strategy for individuals who may not pass a customary life Insurance wellbeing screening.

Whole life

Whole life Insurance approaches offer super durable inclusion, which means you are covered for the length of your lifetime. Along these lines, they will generally be more costly than term strategies. Whole daily routine approaches frequently accompany experiencing benefits, similar to cash esteem, which you can utilize while living to assist with enhancing your pay.

Universal life

All-inclusive life is one more type of long-lasting life Insurance however has a couple of a greater number of elements than Whole life. General extra security is a more adaptable choice for the people who need long-lasting inclusion yet need the capacity to refresh their strategy. With a Universal life strategy, you might have the option to refresh your exceptional sum and your demise benefit.

Assuming that you are thinking about buying a life coverage strategy from Geico, you could get a statement on the web. You can likewise look at the extra security much of the time posed inquiries page for more data on life coverage and who can profit from having it.

Reasons why Geico is a great option

Geico could be a great choice paying little heed to the sort of Insurance you want. The rates it charges are generally expected a lot lower than what different organizations charge, and you can set aside a great deal of cash through limits and packaging.

Without fail, Geico additionally gets high rankings from organizations like J.D. Power and AM Ideal. The organization’s consumer loyalty appraisals and monetary strength have more than once shown that Geico is an insurance agency that can serve a wide base of clients.

Conclusion: 96% – Best Overall Car Insurance

GEICO is a company that accepts portable innovation and makes inclusion reasonable through various limits and projects. GEICO Insurance reviews show that numerous clients like the company for its notoriety and convenience. In any case, likewise with most insurance agencies, some end up disillusioned with parts of the Claims interaction and Customer assistance.

In light of our GEICO Insurance review, we rate it as the Best By and large Car Insurance supplier, since the company performs well in most of our exploration classes.

FAQS

Why should I choose Geico?

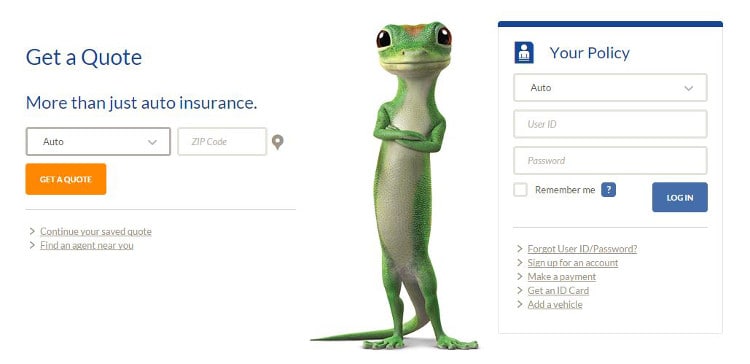

Geico might be a good choice if you are on a strict budget, as the company’s rates tend to be lower than many similar companies. This might be due, at least partly, to the long list of discounts that Geico has. Geico also has exceptional mobile tools, including a mobile app and online customer portal. However, getting quotes from several companies that might fit your needs is always a good practice when shopping for car insurance.

What do I need to get a quote from Geico?

That depends on what type of quote you need. For an auto insurance quote, you will need your address, date of birth, driver’s license number, and the vehicle identification number (VIN) of each car you want to insure. If you have other drivers in your household, you will also need their personal information. To get a home insurance quote, you will need your name and date of birth and some information about your house, like the year it was built, how old your roof is, and if you have updated any major systems.

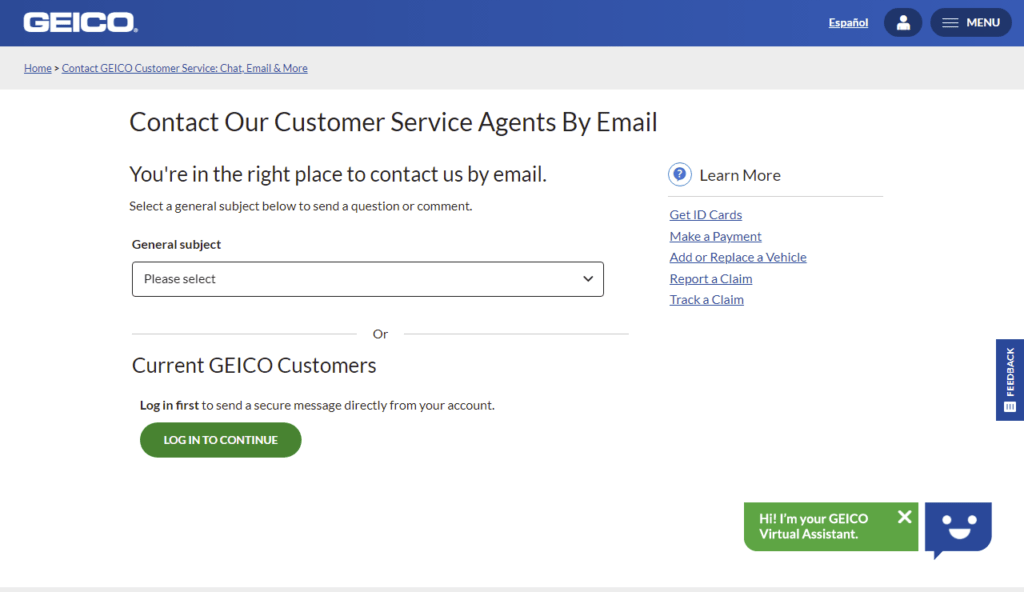

How do I file an auto claim with Geico?

The Geico claims process can be completed online, over the phone, or through their mobile app. When reporting a claim to Geico, you will need to briefly describe what happened, the location where the accident occurred, and the date and time. It is also helpful to have your policy information and the policy information for any other involved parties.

Is Geico a reliable insurance company?

Geico is a reliable auto insurer that’s known for affordable rates and decent customer service. The company received fewer than the average number of complaints about its size in 2020 according to the NAIC, and it scored 881 out of 1,000 points in the 2021 J.D. Power Auto Claims Satisfaction Study.

Is Geico the cheapest?

According to our estimates, full coverage insurance from Geico is about 22% cheaper than the national average. This applies to 35-year-old good drivers with good credit. Geico may not be the cheapest option for everyone, which is why we recommend comparing quotes when you shop.

That was it for this article. If you found it helpful, consider checking out our blog Daily Social News!